The mighty Dr. Copper; the only metal has a suffix attached to his name, for his accuracy predating equity prices for years. In the past 30 months or so, copper had a fantastic performance, almost quadrupled its price from December 2008 lows. But recently, this is becoming more of a story about emerging market infrastructure spree than acclaimed shortages.

An article in daily mail about a Chinese ghost city Kangbashi may give us some idea about the scale of the spree.

From

dailymail.co.uk:

One approach road leads past what was until recently a 30,000-seater stadium, costing £100 million and rushed to completion in nine months for last year's Mongolian Games - horse-racing, archery and wrestling. When it was opened, it looked rather like Concorde about to take off. But soon after New Year's Day, a whole white wing, plus the central peak, collapsed during the night. http://www.dailymail.co.uk/....

|

| Refined copper imports by country in 2010 |

As the ancient Chinese saying goes:” one shall invest in art in heyday and own gold in troubled times:” With some Chinese art prices soaring to unprecedented levels, not doubt we are in a boom time. However, anybody who studied some history may ponder the question whether this time is different. Looking at the media flooded with articles about how superior a state-driven fixed asset investment economy is, I couldn’t help but wonder if anyone experiences the same déjà vu as I do.

|

| Sotheby Indicator |

Supply wise, for all the Malthusians I’ve got bad news for you. BBC just discovered new source of copper supply! They are in Goldman’s warehouse! Several prominent website has already covered this story in detail:

BBC bubble trouble interview via

ftalphavilla.ft.com

MR: In fact it turned out that only about 40% of the copper was on the LME’s official stocks, and therefore visible to the market.

From

Zerohedge.com:

The primary driver of this anti-competitive behavior is the fact that GS, JPM and Glencore now control virtually the entire inventory bottlenecking pathways: "In recent years, major investment banks like Goldman and J.P. Morgan and commodities houses like Glencore have been snapping up warehouses around the world, turning the industry from a disperse grouping of independent operators into another arm of Wall Street. The LME has licensed about 600 warehouses around the world. http://www.zerohedge.com/......

Copper guru Simon Hunt explained:

The real story about copper is the size of the financial sector’s involvement in buying surplus copper and warehousing it outside the reporting system both in your country and elsewhere, which probably started in 2006. This is what creates robust demand, which is quite different to consumption.

I’m also a big believer in seasonality; the chance of a market collapse in autumn is just too high for me to discredit markets seasonal traits. So I examined three major housing bubble in the past 20 years or so, the Japan asset bubble, Asian tiger, and US housing bubble and put them into a seasonal perspective, presidential cycle in this case. These three housing bubbles are each characterized by the same stated-induced cheap credit, reckless speculation, and debt fueled asset inflation. And here is the result:

|

Seasonal copper price during major housing bubble

|

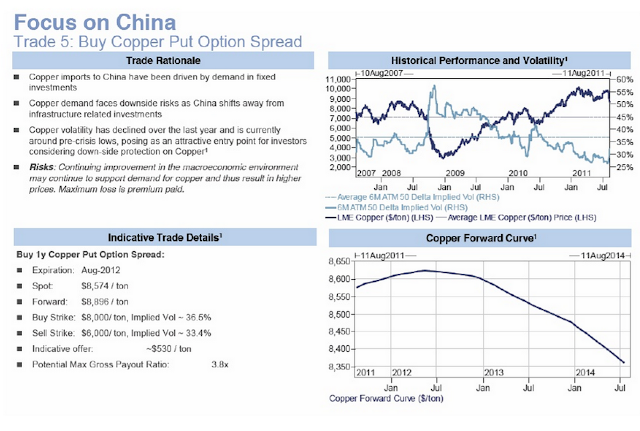

If the Chinese housing bubble talk is validated, with inflation pressure mounting up and further tightening measures in emerging market, Simon hunt’s prediction of copper price plunging to 7500 level surely could be realized by year end. After that, copper price tend to rally at the beginning of election year, and an even lower copper price in second half of 2012 is not avoided.

I will continue to monitor closely the market developments, feel free to visit my website: riskhacker.blogspot.com.